Carbon

Mobile Banking & Loans

Description of Carbon: Mobile Banking & Loans

Total control of your finances is possible! Meet Carbon, a credit - led pan African digital bank, your all in one app for easy money management.

Track and simplify your personal finances with our easy spending and payment options.

Say goodbye to hidden bank charges, long queues and endless paperwork.

Carbon’s digital banking services are designed to change the way you bank, pay, spend and earn.

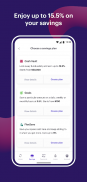

Change the way you Earn with Carbon

With Carbon your money is always working for you. Save smart and earn more with up to 15.5% interest per annum on your savings.

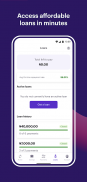

Change the way you achieve your goals

We’ve made loans easily accessible to you to help you reach your goals and stay in control.

*What you need to know about our loans;

•Loan amounts range between ₦2,500 to ₦1,000,000 with repayment periods from 61 days to 12 months at monthly interest rates that range from 4.5% to 30%

•The Max APR is 195% per annum

•No collateral or guarantor necessary

•No hidden fees

•You unlock higher loan amounts by repaying early and carrying out other transactions on the app.

*Representative example: Loan amount of ₦1,000,000 borrowed for 12 months. Monthly Interest Rate: 4.5%. Total amount payable: ₦1,540,000. APR: 54%.

0.03333% per day late fee

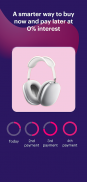

Change the way you Pay with Carbon

Say hello to Carbon Zero, our Buy now pay later product. Spread payments for any purchase with your Carbon debit card into four installments for anything you love and pay over four interest-free installments.

Change the way you Spend with Carbon

Who needs cash when you’ve got a Carbon debit card #PinkPassport. Spend and earn in one place with Carbon. Enjoy 1% cashback monthly on every card (POS) transaction. Terms and conditions apply.

Here’s why you’ll love Carbon:

Your Carbon bank account allows you to do more than store money. Instead of fees, we give you 1% of your account balance every month. Enjoy free transfers, zero maintenance fees, instant loans of up to 1 million.

Instant Loans are available 24/7

We’ve made access to credit easy and simple. Get the best loans in Nigeria with our secure bank loans. Available 24/7, no collateral or guarantor necessary.

No hidden fees ever

You can bank on our transparency. Carbon gives you a clear breakdown of your transactions.

Real-time alerts

Where your money goes doesn't have to be a mystery. Receive instant notifications for every incoming and outgoing transaction.

Fast, simple and secure payments

Transact in seconds, send and receive instant bank transfers, and enjoy instant reversals on failed transactions.

Reliable customer support

Focus on having fun. We’ve got an amazing team of customer service for urgent queries, so we’re always here. You can always reach us to raise queries or learn more about our services via our different support channels. We’d love to hear from you!

You’re always in control

The Carbon debit card is your passport to financial freedom and security. Freeze your card temporarily or permanently, cancel or deactivate your card, reset your card pin, set recurring transactions, and customize the names of your saved beneficiaries, all in your Carbon app.

Safe and secure banking

Deposits are NDIC insured. Carbon microfinance bank is licensed and regulated by the Central Bank of Nigeria with the RC number: 1642222.

Carbon products include:

Carbon savings

Carbon loans

Carbon Zero

Carbon debit cards

Carbon SME loans

Join over 3 million customers who trust Carbon to save, spend and manage their finances on the go. Start banking with Carbon today.

Instant loans whenever you need it.

We’ve made loans easily accessible to you to help you reach your goals and stay in control. Unlock higher loan amounts by repaying early and carrying out other transactions on the app.